Do you remember receiving pocket money as a child? Wasn’t it one of best moments when you slide your hand into the pockets and find money?! And you’d probably lie to yourself if you say that this was something you weren’t the most excited about. The next thing you would do was to spend on food, games and very little on books or stationery for school. Some of us liked to collect and store it in our piggy banks, and the rest would immediately set out to spend it. And since it was the money that was completely ours, we didn’t need to seek any permission from our elders as to where and how we could spend it; well, usually.

Suppose you received Rs 100 as pocket money. You plan on buying a beautiful but expensive toy, which costs Rs 40. Then you decide to spend Rs 20 on sweets and chocolates and the remaining Rs 40 on buying a pencil box. Fund management, right? Now imagine your mother puts a limit on your spending and asks you not to spend more than Rs 30 on the toy and spend more on the pencil box and similarly limits your spending on the chocolates and sweets. What do you do now?

A similar situation was put forth by the Securities and Exchange Board of India (SEBI) in front of the Indian investors. On September 11, SEBI decided to limit the investments in the multi-cap equity mutual funds, which will significantly change the Indian investment practices.

What does the new SEBI multi cap fund rule say?

The Securities and Exchange Board of India (SEBI) on September 11 issued new guidelines asking multi-cap funds to invest at least 25% of their total assets, each in small-caps, mid-caps, and large-cap stocks, leaving the remaining 25% to their choice of investment. According to the new norms, these funds should have at least 75% of its asset allocation in equity and equity-related investments at any point in time.

Earlier, multi-cap funds used to invest around 70-80% in large-cap stocks. With the motive of keeping multi-cap funding true to its name, this value was restricted to just 25% with SEBI’s new multi-cap fund rule.

These new norms were introduced with the motive of motivating a fair influx of money in all the three categories of stocks, be it large, mid or small. Ideally, a multi-cap should have a representation of all cap stocks, which were mostly large-cap until now.

Effects of SEBI’s Multi-cap fund rules

The major effect of SEBI’s multi-cap fund rules will be on the multi-cap funds, which had, up until now, been majorly investing in the large-cap stocks.

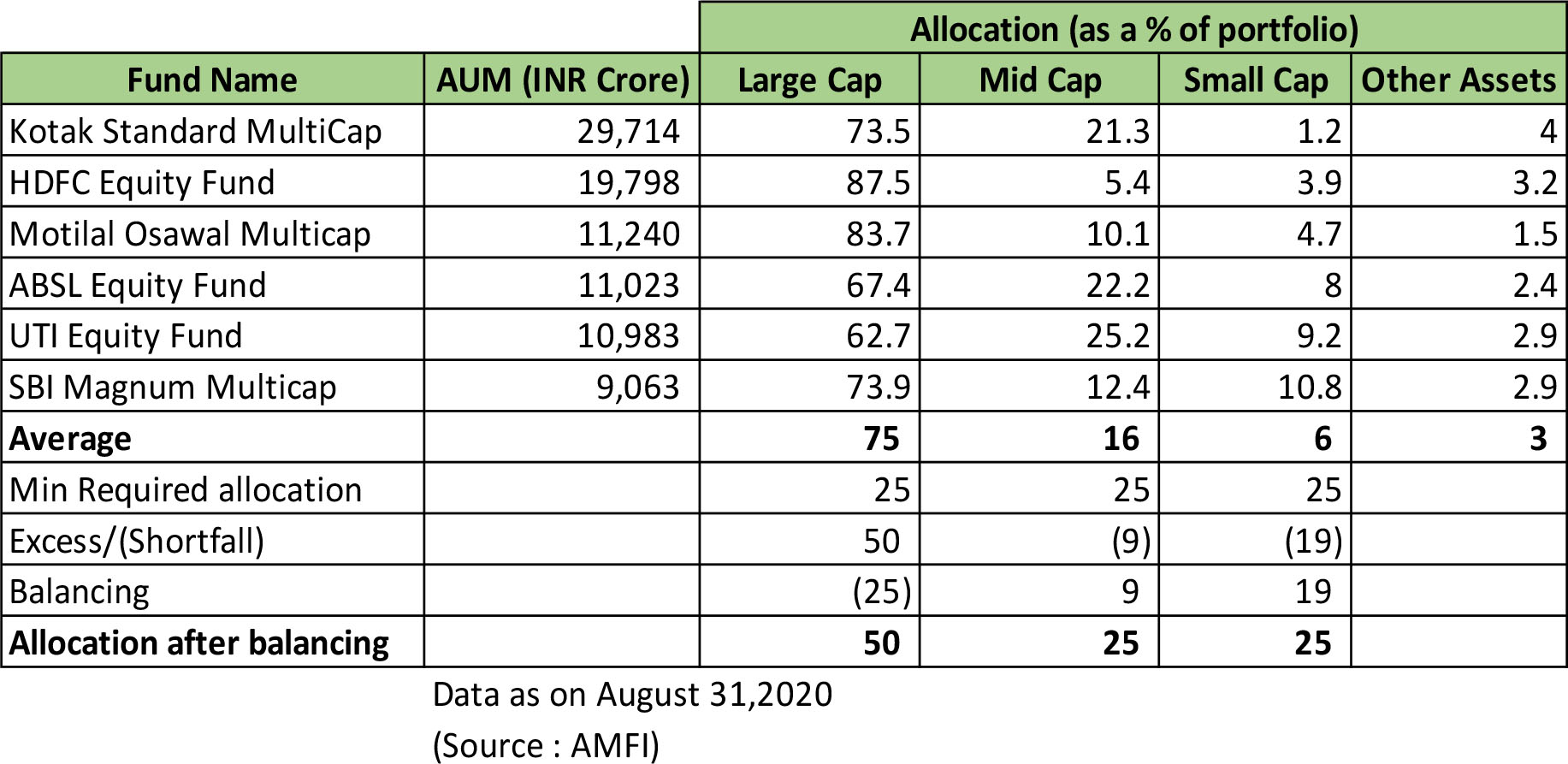

Upon certain research on fund allocation by multi scheme fund managers it was observed that some multi-cap funds would invest up to as high as 70-80% of funds in large-cap stocks and the remaining in stocks of the small-cap and mid-cap companies, while some leading firms went even higher to the extent of 85-90%, thus, leaving very little for the small-cap and mid-cap stocks.

However, the new guidelines will now force these funds to limit a big part of their large-cap investment and move their funds in mid and small-cap stocks. Does this mean that there will be a large movement of investments into the mid-caps and small caps? Let’s see!

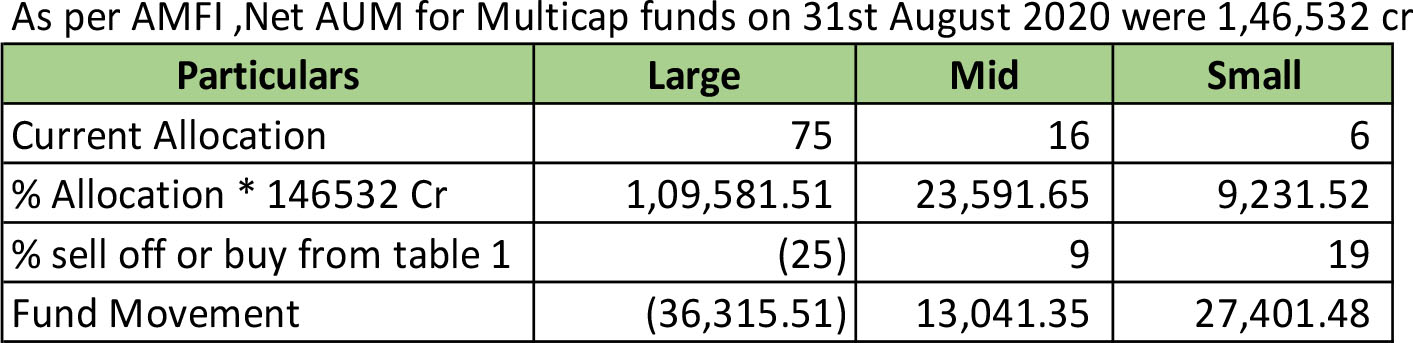

Based on the above table prima facie there should be a shift in multi-cap funds can lead to about Rs 27,400 crores moving into small-cap companies and about Rs 13,000 crores into midcaps companies. They have also predicted that there will be select firms in these categories which will get the maximum allocation as a result of the new rule.

Impact on fund management

The new SEBI multi-cap fund rules will majorly impact the fund managers who previously had the flexibility to allocate funds in accordance with the ever-changing market dynamics.

Multi-cap funds gave fund managers the liberty to choose the market cap they felt best in terms of the on-going equity market situation. The fund managers had the freedom to invest across different industries and market caps based on their personal outlooks. The only restriction was that 65% of the portfolio had to be in equity.

SEBI’s multi-cap fund rules have now taken away this flexibility of choosing the allocation of funds. With 75% of funds having to be allocated strictly in all the three market caps, the fund managers will now have only 25% of the funds to their own discretion. The new rules will also force them to stay invested in the stocks irrespective of their market capitalization performance.

The major challenge will be the movement and increase of funds into the small caps and their management if the previous investment strategy avoided small caps and focused majorly on the large caps. Until now, only a handful of fund managers have been able to post consistent performance in the small caps.

The immediate next question arises that if only a handful of fund managers are able to perform in small cap stocks, will the multi cap mutual fund scheme segment show declining growth? Maybe yes Maybe not. Fund managers could make a smart move here by merging two or more mutual fund schemes into to a single fund. Or will fund managers increase holdings to 80% or more in large cap stocks and thereby convert the multi cap scheme into a large cap scheme. Wait, does this mean there could be rally in large cap stocks instead of expecting a rally in small and mid-cap stocks? Maybe yes Maybe not.

Another point to ponder upon that the minimum requirement to be called as an equity or equity oriented mutual fund is 65% investment in equity instruments but now it shall be increased to 75% (25% + 25% + 25%).

How will SEBI’s Multi-cap fund rule impact you as an investor?

The new set of SEBI’s multi-cap fund rules might change the face of the market cap equity investments forever. These new rules will increase exposure to the mid-cap and small-cap stocks, which might increase the volatility of returns on stocks. Multi-cap funds can no longer be considered as an alternative to large-cap funds.

Henceforth, a fund manager’s ability to assess and perform well with mid-cap and small-cap stocks will be a major factor that will determine the success of a multi-cap fund. Depending on their desired fund allocation across various sectors of market capitalization, investors will now have to reassess their exposure to multi-cap funds.

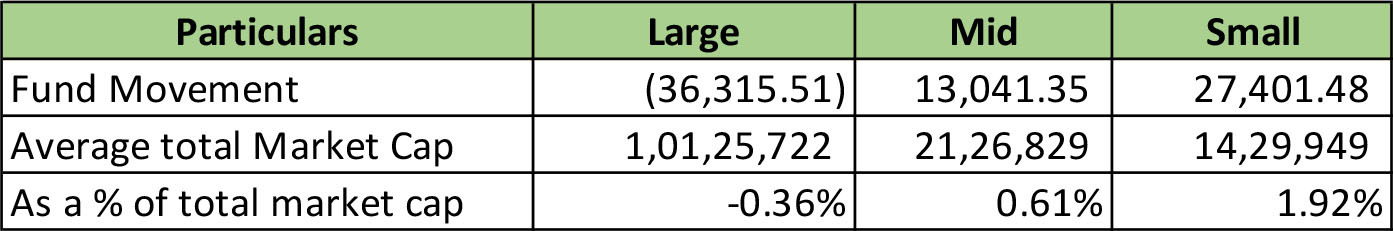

Should you expect a crash in the stock market because of huge sell off in large cap stocks? No.

In absolute terms, the probable wipe out from large cap stocks looks like a huge sum but when compared to the average market cap such movement shall hardly impact the investors of large cap stocks.

As per AMFI, Indian stock markets witnessed a net outflow (Investment – Redemption) of 14,500 crores in mutual funds in August 2020. Did this lead to a crash in nifty stocks? Certainly not and on the contrary the stock markets have been moving on an upward trend.

If, as an investor, you need not panic in the view of expecting a huge sell off in large cap stocks and instead if you had previously planned to explore the mid-cap and small-cap funds, multi-cap funds may be a good idea now. However, if you already have investments in the mid-caps and small caps, and you wish to retain a healthy mix, you can choose to move towards large-cap investments.

Conclusion

Going forward, with the new set of SEBI’s multi-cap fund rules, both the investors, as well as fund managers will have to be extremely selective and careful in identifying good stocks.

For now, we can simply sit back and observe what the mutual fund companies are planning to go about in this new era of investing. It is better to plan things out, though.

So, just as your daily allowance, hold on tight to your money, analyze the market and opportunities, and carefully lay down your action plan. Will it be the precious toy, or the pencil box, or both as well the chocolates and the sweets? Plan ahead.

Author

![]()

Vivek

Vivek is a Senior Analyst and is associated with KVA over 2 years and has gained exposure in areas of Taxation, Advisory and Assurance services to corporates ranging across varied industries and magnitudes. He is an enthusiast of capital markets and has keen interest in analysing impact of micro & macro economics on business sectors.